Global Small and Medium Sized Business Financing Need

The International Finance Corporation (IFC) estimates that 65 Million firms, or 40% of formal micro, small and medium enterprises (SMEs) in developing countries, have an unmet financing need of USD 5.2 Trillion every year. There are 200 to 245 Million formal and informal enterprises that do not have access to loans or overdrafts, but are in need of one—also referred to as the unserved sector. Due to many factors, including unclear financial regulations, high registration fees, and volatile economic conditions, many SMEs find it difficult to source liquidity at affordable fees from well-established financial institutions and hence must resort to informal lenders at higher borrowing rates or sell their invoices at lower face value.

Decentralized Finance and Crypto Liquidity Pools

Decentralized Finance, or DeFi is the new buzzword in finance with potential benefits for SMEs. DeFI uses a pair of crypto assets to form liquidity pools. Individuals can borrow against their crypto collateral to borrow from the pool and pay back with interest. For more information about DeFI and liquidity pools, please refer to this article.

The big question is how to collateralize traditional invoices to borrow from the pool. Unlike crypto assets, traditional invoices are created off-chain in an enterprise environment. Hence, there must be a “digital twin” of the invoices on blockchain, meaning the attributes of the invoices must be on the chain, preferably in smart contracts. This allows the creation of a Non-Fungible Token (NFT) that represents the invoices. These invoices then become on-chain assets ready to be collateralized in crypto pools.

“Lower” Borrowing Cost of DeFi

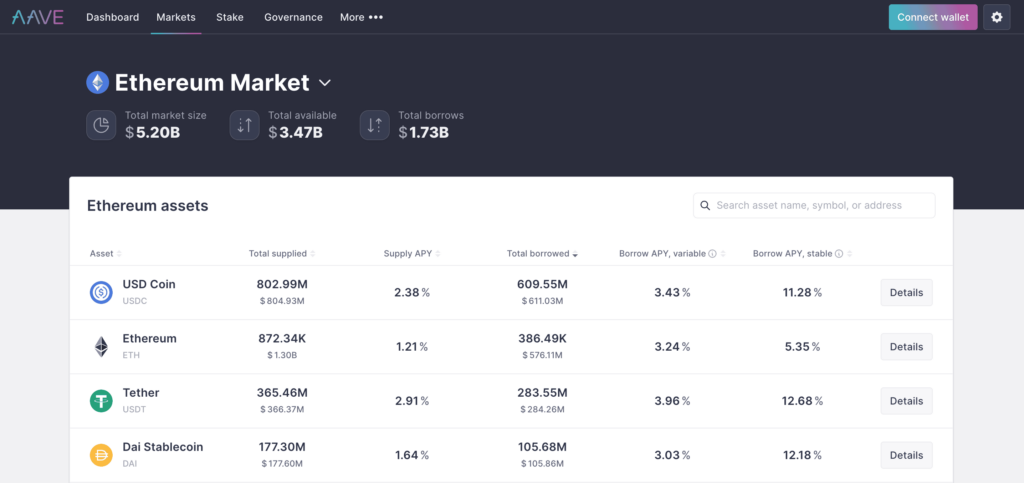

Because the borrowing process is completely automated and liquidity pools do not have much administrative cost, the overall cost of borrowing may be much lower than borrowing from traditional factoring companies and financial institutions. However, that is not given and depends on the pools. Most liquidity pools tout themselves as providing higher yield for liquidity providers than traditional lending, which translates to higher fees to borrowers. Also, pools can be highly volatile due to the volatility of the underlying crypto assets used to create them. Most pools are variable. AAVE is one of the unique decentralized exchanges (DEX) that provide stable borrowing rates – please refer to “stable borrowing APY” in the image below. It also shows borrowing rates for different pools in AAVE. The cheapest borrowing rate is ~3%, which is significantly lower than borrowing rates offered by traditional financial institutions for short-term liquidity/cash requirements, especially in developing countries. For comparison of borrowing rates to SMEs by countries, please refer to the OECD’s website. It shows that borrowing rates can range from 1% (e.g., Austria) to over 40% (e.g., Brazil) for SMEs.

NOTE: In this blog, we will not discuss how DeFI liquidity pools are created and how borrowing rates are defined.

Risks of Using DeFi to Source Liquidity for SMEs

One of the major risks for SMEs by using DeFi pools to source liquidity is the volatility of their interest rates. Hence, SMEs must be cautious about which pools to borrow from.

The other risk is the possibility of default by the invoice payee. then the lenders have to “recourse” to recoup those funds, which can be quite expensive. Alternatively, they can dump the invoices in a secondary market at a much lower face value. Depending on the market and industry type, defaults can be minuscule.

Acceptance of DeFi by the SMEs

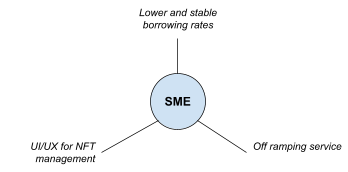

SMEs typically do not have the in-house expertise or development tools to create a digital twin of invoices on blockchain to create NFTs. They must use services provided by third parties, and marketplaces such as dexFreight to borrow funds from the liquidity pools. These third parties guarantee stable borrowing rates (at least for pre-agreed-upon time periods) by being flexible enough to choose liquidity pools that are low risk. The third parties must also provide a seamless user experience to create NFTs of invoices, custodial wallets, borrow funds from appropriate pools, and off-ramp to local fiat on behalf of the SMEs.

For SMEs to borrow from the liquidity pools, the borrowing rates from DEXs must be multiple times cheaper and easier than borrowing from traditional financial institutions.

Projects Bringing DeFi to SMEs

dexFreight

Since last year, dexFreight has been building dexFI (patent pending #20230004925), which uses the concept of DeFi to source inexpensive liquidity to fund invoices of trucking companies. The fees to SME trucking companies are much lower than traditional freight factoring in the US.

In order to offer an inexpensive alternative to factoring, dexFreight allows trucking companies and freight brokers to lock their invoices in DeFi money markets, and borrow against this collateral at market rates set by one-sided money markets like MakerDAO or two-sided money markets like AAVE.

Credefi

Credefi, based in Sofia, Bulgaria, offers a different product than connecting SMEs to DEXs. Instead, it has built an infrastructure that allows crypto lenders to lend directly to SMEs. That means there are no liquidity pools in DEXs to borrow from.

Money On Chain

Based in Argentina, MOC is an ambitious project that aims to bring DeFi lending backed by Bitcoin to SMEs in the Latin American market. Its flagship product is Dollar on Chain (DOC), a Bitcoin collateralized stablecoin pegged to the US Dollar, where the value of 1 DOC token is equivalent to 1 US Dollar. It operates under the Money on Chain (MOC) protocol built on the RSK ecosystem. The core values of MOC are to harness Bitcoin volatility with a trustless token system and the first-ever Bitcoin-collateralized stablecoin.

About dexFreight

dexFreight is a logistics market network with FinTech capabilities, for freight companies to handle shipments from booking to payment in one place using smart contracts. dexFreight connects carriers, freight brokers, shippers, and other actors of the supply chain through an open logistics network, built on decentralized protocols. For information, visit www.dexfreight.io

CIO and Co-founder at dexFreight