Stepping back from the NFT craze

By now, (almost) everyone has heard about NFTs. Even my 4th grader has heard about it.

But the thesis of this blog is that NFTs have many potential uses in businesses, beyond the art NFT craze.

Tokens mean a piece of paper/metal/data that represents something of value or a right bestowed by someone to do something. Ikea gives you a token when you go to return your merchandise. Gaming parlor gives you 100 points printed on a long piece of paper as a reward. The Ikea token gives you a “right” to be in a certain place in the queue. Gaming parlor token gives you the right to buy a lollipop of the same value at the gaming parlor’s store. Casinos in Las Vegas give you a piece of plastic against the dollar. In many ways, a dollar bill we carry is also a token. The bill holder has a right provided by the US government to be used as a legal tender. A credit card provided by a bank is also a token because it has given the card holder a legal right to use it to make purchases wherever it is accepted.

You see, we’ve been using tokens for a very long time.

So, what makes them tokens?

If you’ve noticed in the above examples, tokens have two distinct attributes:

- A clearly defined/scoped rights represented by the token.

- An existing entity/person that provides those rights.

For a token to be useful it must have three other attributes:

- Trust in the provider (we trust Ikea will honor its tokens.)

- Witness to its rights/value (for example, you can walk up to a bank and ask if they will accept the US dollar bill.)

- Verification of the right/value of the token and that there are some established mechanisms for the token holder to verify its rights/value.

There are two types of tokens – FTs and NFTs

Fungible Tokens (FTs)

Fungible token means you can divide a token into pieces and it still retains its value. For example, a $100 bill can be exchanged for two $50 bills. You can walk up to a bank, exchange a $100 bill to five $20 bills and give each to your five friends. Gaming parlor tokens can be broken into half and you’ll still be able to buy smaller lollipops.

Non-Fungible Tokens (NFTs)

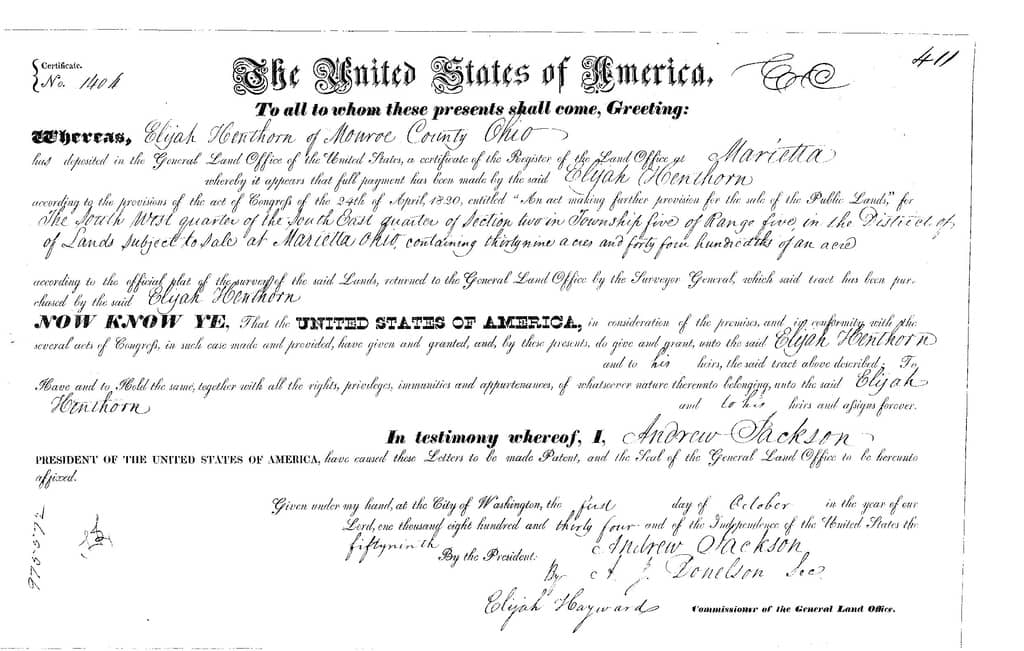

Non-fungible tokens represent rights/values that are difficult to break into pieces. Difficult in the sense that by doing so it may lose its value significantly and/or is difficult to do so within the boundaries of the law. For example, you can sell your 1 acre land to five of your friends but by doing so your friends may lose substantial market value of their individual pieces. Some states/counties may not even allow you to sell such tiny pieces of land, because of existing laws limiting size of acreage. In this situation, your only option is to transfer/sell it in whole to another person/entity.

Fast forward to January 2018, NFT was born

After Ethereum as a decentralized public blockchain came into existence with the ability to transfer value between two entities using smart contract, ERC20 token standard was proposed by Fabian Vogelsteller in November 2015, as a Fungible Token Standard that implements within Smart Contracts. Then in January 2018, the ERC-721 (Ethereum Request for Comments 721) as a Non-Fungible Token Standard was implemented. This particular standard allowed creation of NFTs in the Ethereum network. In it, an NFT represents an asset and who owns it. The Ethereum blockchain ensures that both identities (of asset and the holders) are globally unique and tamper evident. The same way the land title (above) is globally unique for that particular parcel of land in Ohio.

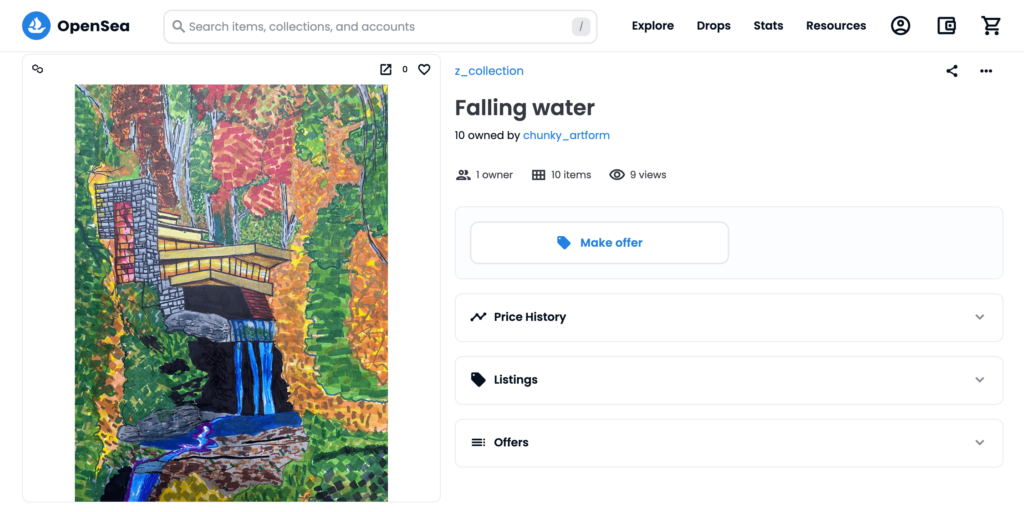

NFT has use beyond rights to own digital arts

“Art NFTs are not the be all and end all of NFTs.”

Art NFTs give you rights to own the art pieces by adding a transaction stating such in an immutable ledger. Art NFTs also provide you a right to perform certain actions on an asset. Digital art is one type of digital asset. In businesses we create many types of digital assets – invoices, contracts, securities, access to data, data itself, land titles, car titles, and many more. For example, an originator or holder of an invoice asserts a legal right to be paid the amount mentioned in the invoice for the services it provided to a customer. It is a type of token limited in scope/value agreed upon by two transacting entities (i.e., the originator/service provider and the customer.) Invoices are a non-fungible type, because it has a unique holder or holders. Also, selling the same invoice to multiple banks would certainly be illegal, and it’s difficult to split it without incurring significant administrative costs.

NFTs reduce the cost of “administering” digital assets

“Splitting the assets for multiple ownership”

There are two challenges in creating multiple ownership of an asset (physical or digital) – 1) it’s not difficult to imagine the administration cost (e.g., legal fees, contracts, negotiations) of breaking an asset and selling pieces to multiple people, and 2) holders of those assets must rely on this third party to be available all the time and provide necessary services that are based on trust.

“Transferring ownership of assets”

Transferring ownership of assets as it is done in the securities market requires complex contracts and third parties involved. Digitizing such assets on blockchain reduces the need of third parties, which are also a single source of failure.

“Verifying chain of custody and existence of assets”

One of the key features of blockchain is traceability of transactions all the way to its genesis (first block). Because permissionless blockchains have a tamper evident feature and immutability, it is easy for parties to trace who owns the asset, whether it was transferred to another party and even querying if the asset exists.

Because blockchain provides a “trust layer” that was not available to us before, it will certainly reduce the responsibilities of intermediaries and hence reduce the cost of “administering” assets.

In Part 2…

Now you’ve understood that art NFTs are just a start, and will ultimately find their way into businesses to create NFTs of various assets; in Part 2, we will explain how NFTs of these assets (like invoices) are created in the blockchain.

About dexFreight

dexFreight is a logistics market network with FinTech capabilities, for freight companies to handle shipments from booking to payment in one place using smart contracts. dexFreight connects carriers, freight brokers, shippers, and other actors of the supply chain through an open logistics network, built on decentralized protocols. For information, visit www.dexfreight.io

CIO and Co-founder at dexFreight